20+ mortgage tax credit

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Verify Your Eligibility Today.

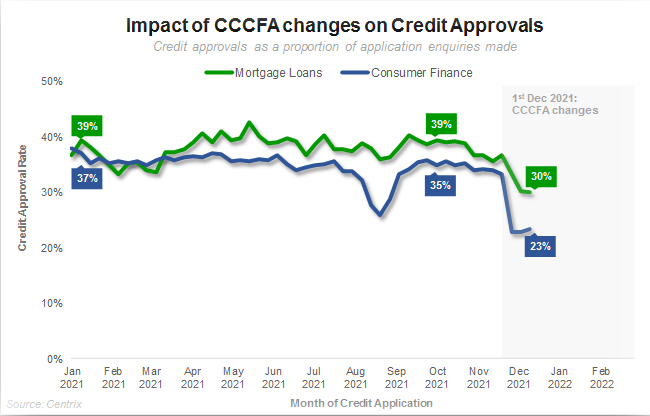

Are We In A Credit Crunch Yet Is One Coming Interest Co Nz

The size of the credit does depend on the area of the country you happen to live in.

. Ad Taxes Can Be Complex. Web A mortgage calculator can help you determine how much interest you paid each month last year. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could.

Web The Mortgage Tax Credit Certificate is an amazing opportunity to get up to 2000 back per year as a tax credit for the life of your mortgage. Web From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income. Web If you receive a 20 MCC then youll receive a 1600 tax credit.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. This means you can cut your final tax bill by 20 of your interest. Finance costs 100 of 20000 20000 property profits 43000 adjusted total income exceeding Personal Allowance 32000 The.

Web The credit can be used for each future tax year in which the mortgage is held that the homeowner has a tax liability. Get up to 26K per employee from the IRS With the ERC Tax Credit. Web Tax break 1.

The standard deduction is 19400 for those filing as head of household. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. The remaining annual interest is deducted from your gross income.

Ad Compare the Best Home Loans for March 2023. Our Specialists Can Help. 15 2017 can deduct interest on loans up to 1 million.

20 set by the state In this example with an MCC rate of 20 you are eligible to claim a tax credit worth up to 2000 20 of. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Lets take a look at some of the pros and cons of using a mortgage.

You can claim a tax deduction for the interest on the first 750000. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Homeowners with a mortgage that went into effect before Dec.

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Ad Our Tax Professionals Can Help Determine If You Qualify for the ERTC from the IRS. Determining factors may be but are not limited to loan amount and term.

Homeowners who bought houses before. Web The Ohio Housing Finance Agencys Mortgage Tax Credit provides homebuyers with a direct federal tax credit on a portion of mortgage interest paid which could provide up to. Web The tax reduction is calculated as 20 of the lower of.

Is The Mortgage Credit Certificate Worth It. All of the rental income you earn will be taxable and youll instead receive a 20 tax credit for your mortgage interest. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

Businesses Can Receive Up to 26k Per Eligible Employee. Web Borrowers can get up to a 2000 tax credit each year. Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills.

Make Sure Youre Doing Things Right And Maximizing Your Claim. The amount you could save on your taxes with an. Generally the tax credit.

Web It provides a 20 mortgage interest credit of up to 20 of interest payments. Web If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under a qualified mortgage credit certificate. The cap on this tax credit is 2000 per year if the certificate credit rate exceeds 20.

Ad Taxes Can Be Complex. Web 20 Popular Tax Deductions and Tax Credits for 2023 A deduction cuts the income youre taxed on which can mean a lower bill. Lock Your Rate Today.

Web Mortgage credit certificate rate. Our Tax Experts Can Help. Get Instantly Matched With Your Ideal Mortgage Lender.

A credit cuts your tax bill directly. Apply Get Pre-Approved Today. Web How to Claim 20 Mortgage Interest Tax Credit.

Web Most homeowners can deduct all of their mortgage interest. The exact amount of the tax credit is based on a formula that takes into account the mortgage loan the. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Im completing my 21-22 Self Assessment and have given the annual amount for my BTL mortgage interest in the box Residential Property Finance Costs. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes. Web Instead you now receive a tax-credit based on 20 of your mortgage interest payments. Web The portion of the mortgage interest you can claim with an MCC known as the tax credit percentage depends on the state you live in.

The amount of the tax credit is equal to 20. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. This is less generous than the old system for higher-rate taxpayers who effectively.

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax

Premium Online Tax Filing And E File Tax Prep H R Block

Landlord Tax Relief Changes Buy To Let Tax Changes Axa

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

How Do Mortgage Credit Certificates Work

Upres 4

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Landlords Consider Selling Rental Property Over Loss Of Tax Relief While Others Seek To Recoup Their Losses By Raising Rents

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

401 K Loans Reasons To Borrow Plus Rules And Regulations

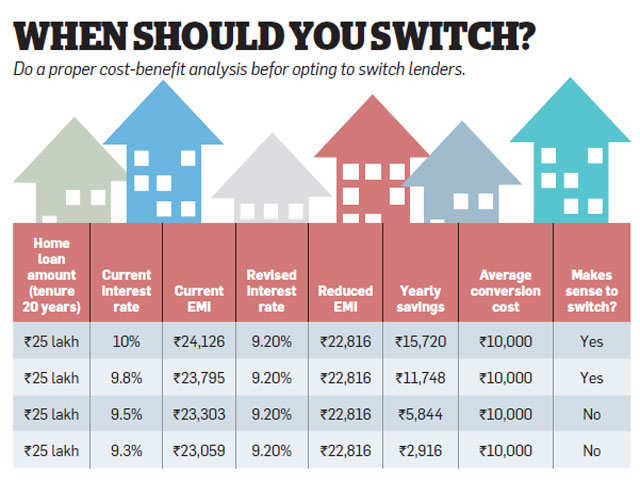

How Existing Borrowers Can Reduce Their Home Loan Interest Rates The Economic Times

:max_bytes(150000):strip_icc()/TaxCredit-cd8d4101b88f4d94afcf390b63f1738b.jpg)

Tax Credit What It Is How It Works What Qualifies 3 Types

6 Types Of Tax Deductions Small Businesses Can Take 2023 Shopify Uk

95 293 Tax Credit Stock Photos Free Royalty Free Stock Photos From Dreamstime

Buy To Let Mortgage Interest Tax Relief Explained Which

The Key Tax Changes For Buy To Let Landlords In 2020 21 Which News

Graph 1 Applying A Tax Credit Of 10 Graph 2 Reduction Of Tax Download Scientific Diagram